b&o tax rate washington state

V voter approved increase above statutory limit e rate higher. For this reason the Department of Revenue does not allow deductions for a Washington LLC or corporation paying the BO Tax.

Washington Updates Requirements For Investment Management Companies To Qualify For Reduced B O Tax Rate Deloitte Us

Tax rate change notices.

. The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax. Rates and bases vary based on the citys needs and business community. Gambling Contests of Chance less than 50000 a year rate 15 percent Gambling Contests of Chance 50000 a year or greater rate 163 percent Note.

ZIP--ZIP code is required but the 4 is optional. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by a simple majority.

List of sales and use tax rates. In addition retail sales tax must also be collected on all sales. The Manufacturing B O tax rate is 0484 percent 000484 of your gross receipts.

Marketplace facilitators such as Amazon typically collect sales tax at. Washington State BO tax is based on the gross income from business activities. Retailing BO tax The Retailing BO tax rate is 0471 percent.

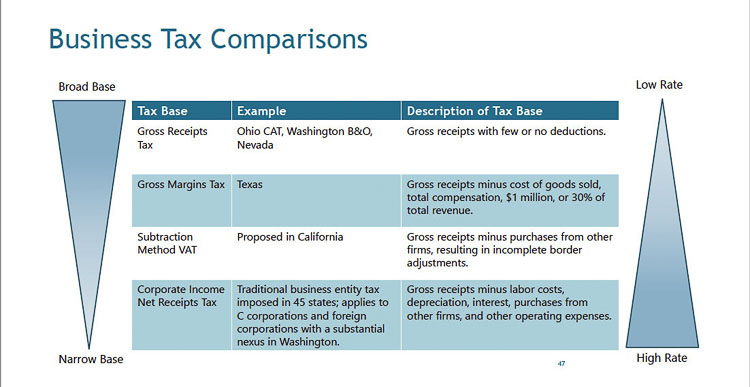

Washington cities may also. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. The business and occupation BO tax is a gross receipts tax assessed on the value of products gross proceeds of sale or gross income of a business.

So for instance in Issaquah total sales tax is 95 but in Pomeroy its. Specified business will pay BO tax at a rate of 18 on their taxable Washington. There are no deductions for.

Washington state doesnt have income. PO BOX 47478 OLYMPIA WASHINGTON 98504-7478 360-705-6705 dorwagov For a atae or o ree doe a aerate ora v dorwagov or a 360-705-6705. 00471 of your gross receipts.

Contact the city directly for specific information or other business licenses or taxes that may apply. Determine the location of my sale. Teee TTY er a e e Wagto Rea Serve ag.

Use this search tool to look up sales tax rates for any location in Washington. The three tiers are as follows. The 2019 Washington legislation includes BO tax updates and a move to a graduated real estate excise tax.

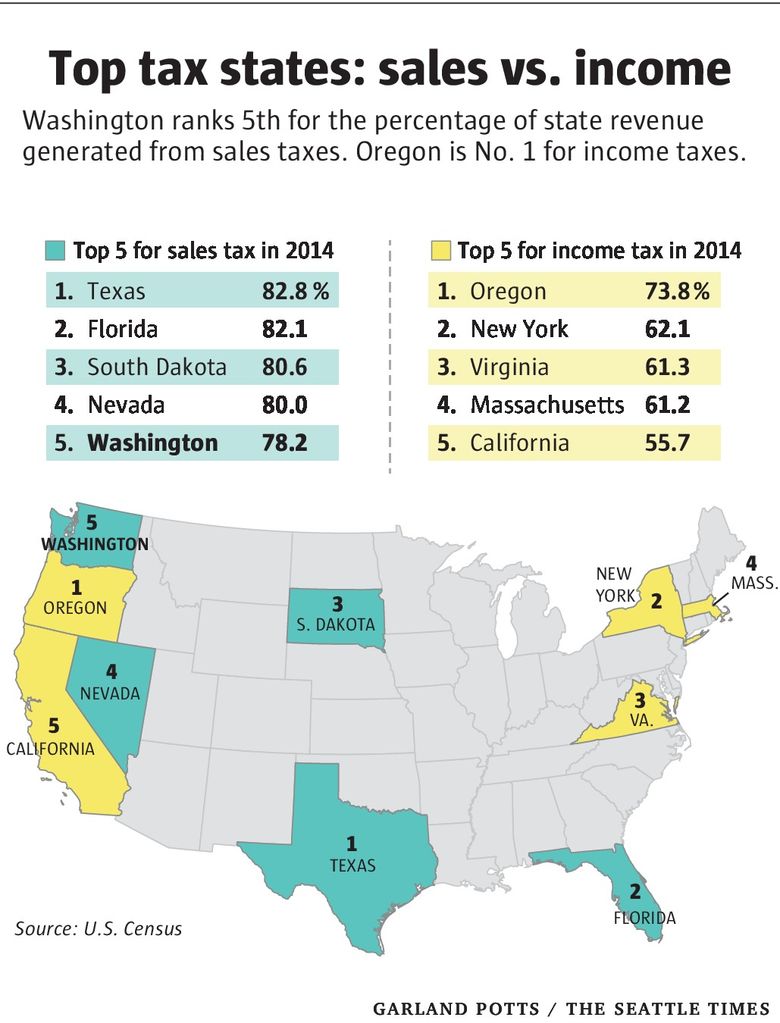

The base Washington state sales tax rate is 65 and each location county or city charges a local rate on top of that. Tax rate lookup mobile app. EHB 2005 RCW 3590 passed in 2017 requires two changes to city business licenses.

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. Lodging information and rates. The surcharge is in addition to the Services and Other Activities BO tax rate of 15.

There is no income tax in Washington State. Have a local BO tax. Heres what the BO tax looks like for your business.

For products manufactured and sold in Washington a business owner is subject to both the. A 20 surcharge on select businesses primarily engaged in any.

Business And Occupation B O Tax Washington State And City Of Bellingham

Tax Filing Example Washington Department Of Revenue

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

A Guide To License Business And Occupation Tax B O Pages 1 5 Flip Pdf Download Fliphtml5

Sales Taxes In The United States Wikipedia

What Types Of Taxes Must I File As A Washington Based Therapist

Federal Taxes Aren T The Only Taxes B O Explained

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

Washington State Tax Updates Withum

Which States Have A Gross Receipts Tax Tax Foundation

Business Occupation Tax Bainbridge Island Wa Official Website

Washington State Ranks Nearly Last In New Tax Transparency Index The Seattle Times

Why Our B O Tax Is Unfair R Seattlewa

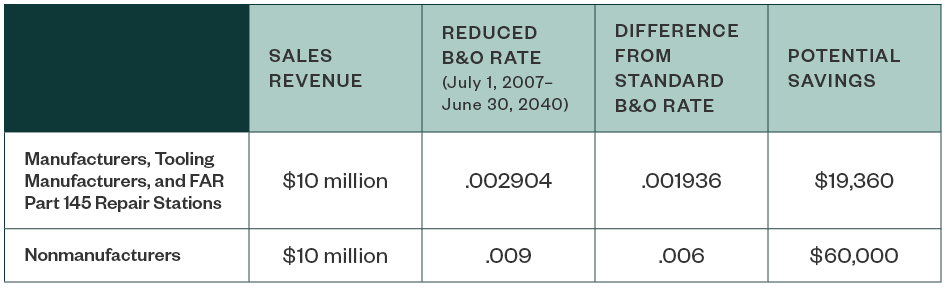

Washington Aerospace Tax Incentives

The Infamous B O Tax Seattle Business Magazine

Allocate Your B O Tax Historic Downtown Kennewick Partnership

Increasing B O Taxes On This Year S Legislative Agenda

When Are Washington State B O Taxes Due In 2021

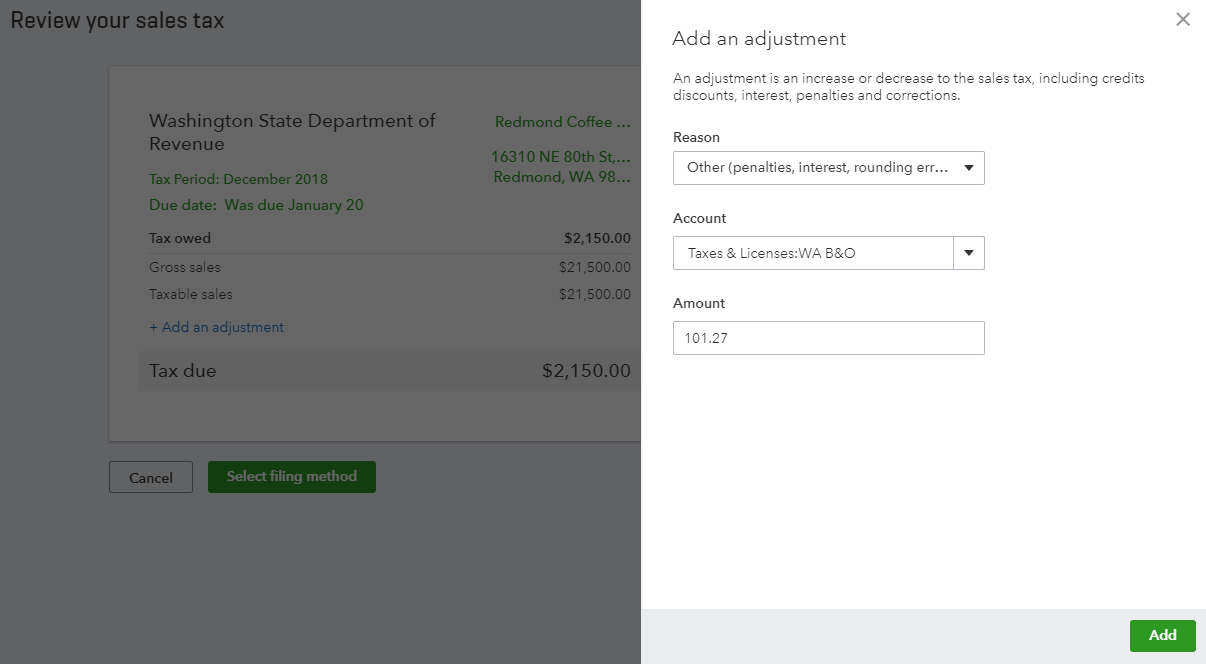

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business