oregon tax payment due date

Payments accepted at the Treasurers Office 850 Main Street Dallas OR between 800 am. However Senate Bill SB 1524 signed into law at the end of March 2022 now requires pass-through entities to pay estimated taxes for the Oregon PTE-E beginning June 15 2022.

Local banks are no longer accepting property tax payments.

. Under the authority of ORS 305157 the director of the Department of Revenue has determined that the action of the IRS will impair the ability of Oregon taxpayers to take certain actions within the. 2021 individual income tax returns filed on extension. Tax statements are sent to owners by October 25th each year.

State of Oregon. Pay the 13 payment on or before November 15th and receive NO discount. April 15 2022 Last date to file individual refund claims for tax year 2018.

5 Due dates of payments for short-period returns. First installment of property taxes due. Do you have questions or need help.

Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. Rule 1 - If the federal tax due is less than 1000 at the end of any calendar quarter the Oregon tax due must be paid by the end of the month following the end of the quarter. An entity must first register with Oregon Revenue Online to make payments which will open on June 6 2022 and make its election annually by the returns due date including any.

Please see Form OR-65 Instructions for due dates for non-calendar-year filers. The first payment is due by November 15th. Mail a check or money order.

Is the department going to charge UND interest when I file my 2021 personal income tax. Oregons April 15 2021 estimated tax payment due date for tax year 2021 has not been postponed and is still due on April 15 2021. Quarter Period Covered Due Date 1st 1-1 to 3-31 April 20 2nd 4-1 to 6-30 July 20 3rd 7-1 to 9-30 October 20 4th 10-1 to 12-31 January 20 Annual Use Fuel User - Annual tax less than 10000 as authorized by the department.

Pay the Full Payment amount on or before November 15 and receive a 3 discount on the current years tax amount. Your browser appears to have cookies disabled. Reports must be received by the department on or before January 20 for each year.

Payment is coordinated through your financial institution and they may charge a fee for this service. If you have any questions the tax office is open during regular business hours. Oregon property taxes are assessed for the July 1st to June 30th fiscal year.

The final one-third payment is due by May 15. The first payment is due by November 15th. November 15th Monday 2021 February 15th Tuesday 2022 May 16th Monday 2022.

Pay the 23 payment on or before November 15th and receive a 2 discount. The Department of Revenue is joining the IRS and automatically postponing the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. Ad The Leading Online Publisher of Oregon-specific Legal Documents.

Pay Online Full Payment. Cookies are required to use this site. Quarter Period Covered Due Date 1st 1-1 to 3-31 April 20 2nd 4-1 to 6-30 July 20 3rd 7-1 to 9-30 October 20 4th 10-1 to 12-31 January 20 Annual Use Fuel User - Annual tax less than 10000 as authorized by the department.

Quarterly Due Dates and Contact Information Sheet UI Pub 139 How to pay. Individuals - Whats New Whats new for tax year 2021 Due dates for individuals March 15 2022 Partnership returns. Due Dates for 2021 - 2022 Tax Payments.

Important Dates Installment Options Postmarks. 2022 second quarter individual estimated tax payments. Oregon Payroll Reporting System COVID-19 Employer Relief Payment due dates Your payroll tax payments are due on the last day of the month following the end of the quarter.

Monday through Friday from 800 am. Pay the full amount of taxes on or before November 15th and receive a 3 discount. The final 13 payment is due by May 15th.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. 4 Payments are due on the last day of the 4th 7th and 10th months of the tax year and the first month immediately following the end of the tax year. Reports must be received by the department on or before January 20 for each year.

It submits withheld tax payments for its nonresident owners on April 15 June 15 and September 15 of the current calendar year and January 15 of the following calendar year. 2022 Tax Rates The tax rates for Tax Schedule III are as follows. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Two Thirds Payment Pay the two thirds payment amount on or before November 15 and receive a 2 discount on the amount of current year tax paid. Oregon property taxes are assessed for the July 1st to June 30th fiscal year. Tax statements are sent to owners by October 25th each year.

Get Access to the Largest Online Library of Legal Forms for Any State. Rule 2 - If the federal tax liability is 50000 or less in the lookback period the Oregon tax due must be paid by the 15th of the month following unless the employer meets the conditions under Rule 1. Yesterday afternoon the Oregon Department of Revenue issued its much anticipated guidance providing income tax relief due to the COVID-19 pandemic.

The second 13 payment is due by February. If a return is filed for a short period of less than 12. Annual domestic employers payments are due on January 31st of each year.

The due dates for estimated payments are. 100s of Top Rated Local Professionals Waiting to Help You Today. April 15 July 31 October 31 January 31.

We now have the final information necessary to fully evaluate the tax relief available for both federal and Oregon income tax purposes in the context of the April 15 2020 filing deadline. 2022 third quarter individual estimated tax payments.

Blog Oregon Restaurant Lodging Association

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

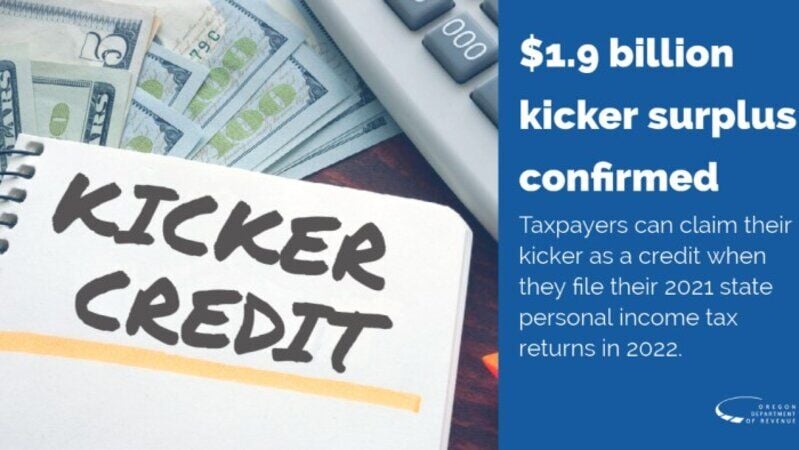

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Follow Oregon Department Of Human Services S Orhumanservices Latest Tweets Twitter

Blog Oregon Restaurant Lodging Association

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Free Printable Late Rent Notice Template Pdf Word

Understanding Your Property Tax Bill Clackamas County

Portland 90 Day Notice Of Rent Increase

Record Accurate And Error Free Ifta Fuel Tax Return With The Help Of Global Multi Services

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com